what is a secondary property tax levy

Land tax is an annual tax levied at the end of the calendar year on property you own that is above the land tax threshold. Questions regarding tax base growth factors may be directed by email to Kristen Forte.

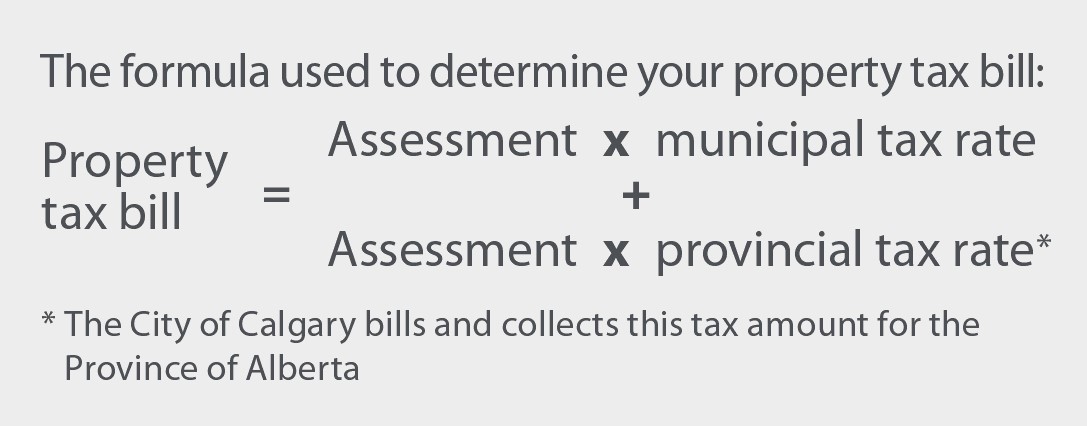

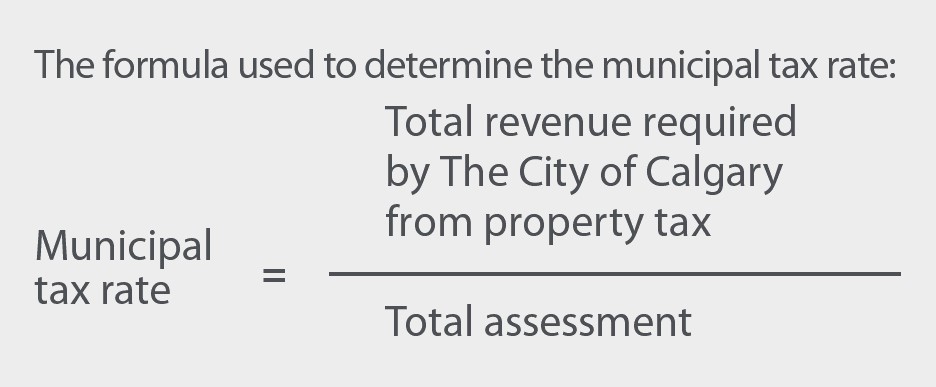

Property Tax Tax Rate And Bill Calculation

Learn more about the three components of annual property tax.

. The amount you pay is based on the funds the City needs to provide City services each year and your property assessment. How land tax is calculated. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

Please be aware the Property Tax Certificate will not include the 2022 Annual Levy until April 1 2022. To determine whether the taxing jurisdiction is collecting more or less in taxes compared to last year look at the percentage change from prior year of the tax levy. 209 Corporate Tax.

A television licence or broadcast receiving licence is a payment required in many countries for the reception of television broadcasts or the possession of a television set where some broadcasts are funded in full or in part by the licence fee paid. Tangible personal property taxes are levied on property that can be moved or touched such as business equipment machinery inventory and. Make changes name address to your tax information here.

Property qualifying as non-revenue 4c3i used less than six days for revenue-producing activities does not pay the state general tax. The tax is levied by the governing authority of the jurisdiction in which the property is located. Find important dates Individual Corporate School Tax Declaration Forms the helpful Property Tax Assessment Tool your tax payment options and more.

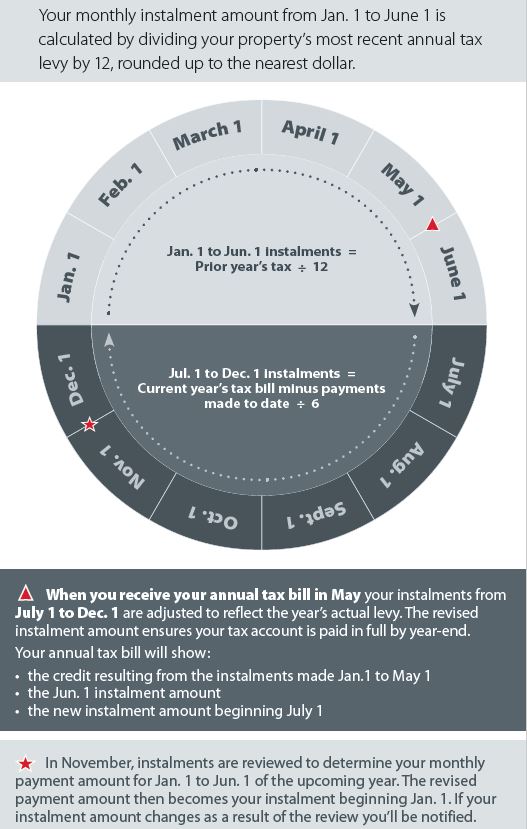

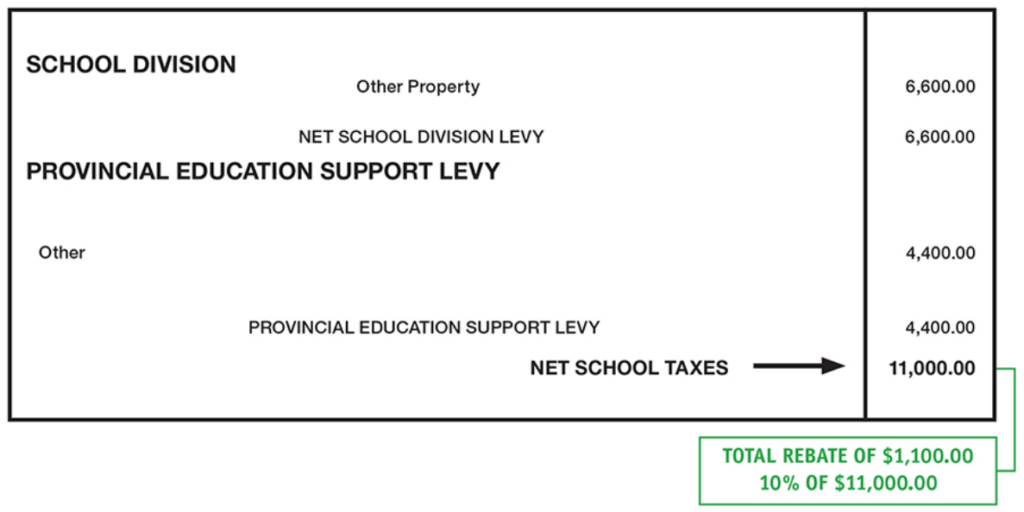

Factors for fiscal years beginning in 2023. 98 Unemployment Insurance Tax. Property tax has two components.

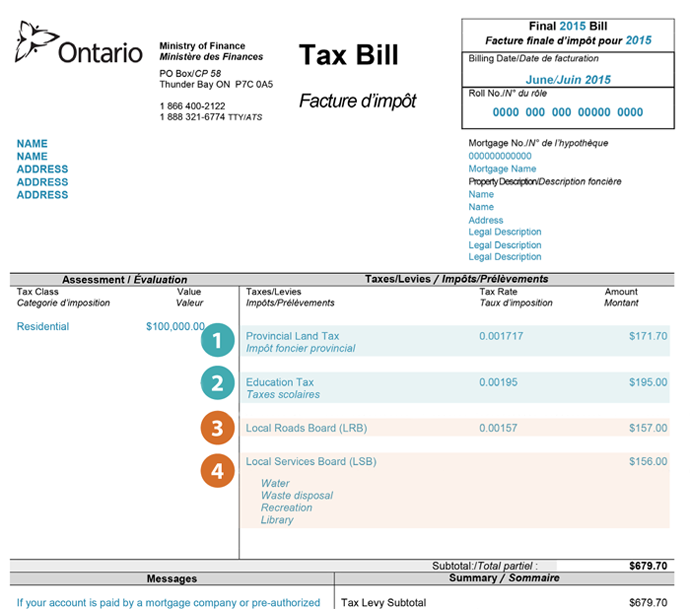

Municipal Tax Library Tax and Education Tax. The County Commissioners assess County Street Lighting assessments Solid Waste Disposal and Collection Reclaimed Water Stormwater Management and Capacity Assessment Units. The phrase gives three examples of the unalienable rights which the Declaration says have been given to all humans by their Creator and which governments are created to protect.

A property can be both 4c3i and 4c3ii if appropriate. Often a property tax is levied on real estate. Unlike private-sector merchants the Treasurers Office cannot absorb processing fees into the cost of doing business.

4c4 Post-secondary student housing. Property Taxes are due Monday July 4 2022 at midnight. Welsh Journals provides access to journals relating to Wales published between 1735-2007.

Real Property Tax Cap and Tax Cap Compliance. What is property tax. This can be a national government a federated state a county or geographical region or a municipalityMultiple jurisdictions may tax the same property.

The Tax Collector consolidates the rolls and mails the tax notices to the property owners. This improves the explanatory power of the State Business Tax Climate Index as a whole because components with higher standard deviations are those areas of tax law where some states have significant competitive advantages. A 5 late payment penalty is applied for outstanding taxes.

For the education portion of the tax are established by the Minister of Finance and help to fund the elementary and secondary education system in Ontario. Property tax is a levy based on the assessed value of property. The exemptions are an attempt to make it easier for homeowners to afford their property taxes.

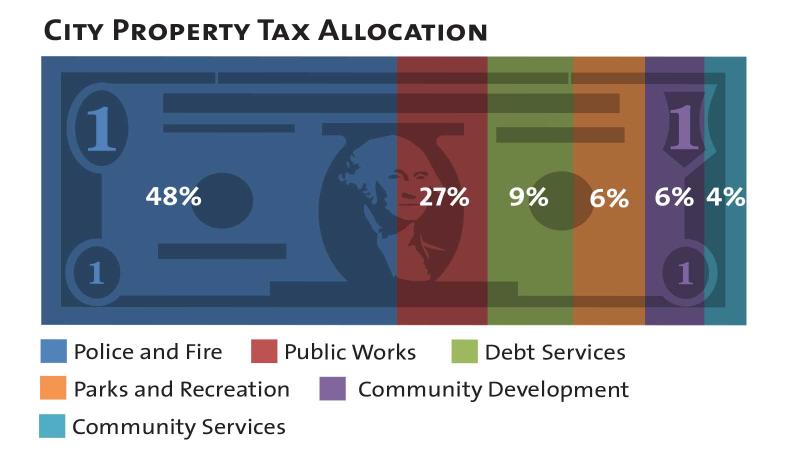

These City services include. Village tax base growth factors. Office of the State Comptroller.

Staff also prepares reports about revenues expenditures budgets attendance and enrollment staffing and school property taxes with information provided by Idahos School Districts and Charter Schools and other governmental entities. Where the reasonable market cost including labour and materials exceeds 10000 and. Tax due date June 30.

Property tax bills cover the calendar year. Like the other principles in the Declaration of Independence this phrase is. Most areas offer property tax exemptions to certain demographics.

The Property Appraiser does not establish the non-ad valorem assessments. Your principal place of residence is exempt and other exemptions and concessions may apply. Businesses that are comparing.

Your tax bill also has the tax rates for each taxing jurisdiction. County tax base growth factors. Find out more about.

Titles range from academic and scientific publications to literary and popular magazines. Upon payment of a fee the Department of Finance will issue a certificate reflecting the total real property taxes and penalties owing to the Province as of the date of issuance and whether the property was subject to a tax sale within. Property qualifying by making contributions and donations 4c3ii does pay the state general tax.

Who pays land tax. A municipal portion and an education portion. Life Liberty and the pursuit of Happiness is a well-known phrase in the United States Declaration of Independence.

Special district tax base growth. The fee is sometimes also required to own a radio or receive radio broadcasts. This lets us find the most appropriate writer for any type of assignment.

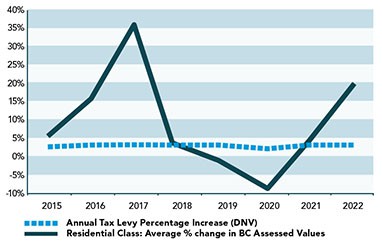

Changes in the tax rate between years are not accurate barometers of changes in the amount of taxes being collected. Property Tax Levies and Average Single Family Tax Bills Property Tax Levies by Class FY2010 to present Municipal Property tax levies by the five major property classes residential open space commercial industrial and personal property as reported on page 1 of the annual tax rate recapitulation sheet for municipalities. Owner-builder work is any work including supervision and coordination of the constructionalterations repairs or additions to a property.

Besides being a source of revenue for the government import duties can also be a form of regulation of foreign trade and policy that taxes foreign products to encourage or safeguard domestic industry. Tax bill mailing May 24. A property tax or millage rate is an ad valorem tax on the value of a property.

Improving Lives Through Smart Tax Policy. City and town tax base growth factors. Which relates to a single dwelling-house dual occupancy or a secondary dwelling that.

Here are the most common property tax exemptions but check with your local government to see what options you have. Many state and local governments impose ad valorem property taxes on tangible personal property TPP in addition to property taxes applied to land and structures. Property owners who have not received a tax bill by the first week of June can request a copy of the bill by visiting property tax document request.

A tariff is a tax imposed by the government of a country or by a supranational union on imports or exports of goods. In addition the Treasurer is not allowed to deduct banking fees from the property tax levy collected which would result in apportioning a lesser amount to the taxing jurisdictions. Tariffs are among the most widely used instruments of.

How to pay land tax. Property taxes are one of the ways the City collects revenue to pay for City services. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines.

In some cases it may even eliminate property taxes altogether. A TV licence is therefore effectively a hypothecated tax for. 144 Property Tax.

Register for land tax.

Property Tax Tax Rate And Bill Calculation

Understanding Your Property Tax Bill Town Of Lincoln

Council Approves 2022 Tax Levy City Of Bloomington Mn

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

City Of Cranbrook Average 21 Increase In Residential Assessments Doesn T Translate Into A 21 Property Tax Increase For Local Homeowners

Understanding Your Property Tax Bill City Of Hamilton Ontario Canada

About Your Property Assessment Tax Rate And Tax Notice District Of North Vancouver

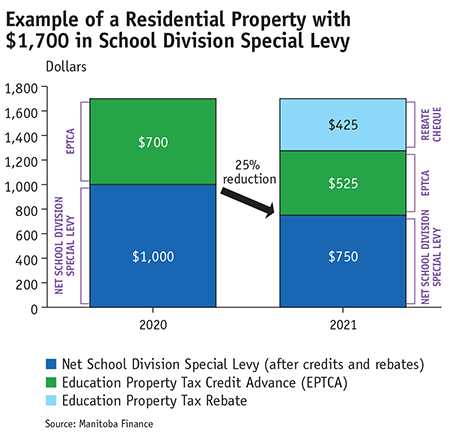

Provincial Education Property Tax Rebate Roll Out Rural Municipality Of St Clements

Understanding Your Property Tax Bill And The Services Supported Provincial Land Tax Ontario Ca

Property Tax Tax Rate And Bill Calculation

Property Taxes City Of Pembroke

2021 Property Tax Bill Guide Rural Municipality Of St Clements

.jpg)